A simplified approach to holistic financial health and well-being for your business

As part of our retirement plan services, TFO LiveWell can offer your business and your colleagues the financial education, tools, and resources to help create your ideal financial world.

Our Belief in the financial wellness gap

A Focus on Reactive Tools Has Led to the Financial Wellness Gap

We here at TFO Wealth Partners believe wholeheartedly in the importance of a well-coordinated financial wellness program. We also believe there is a fundamental gap between what “financial wellness” means to most and what a financial wellness program should be to make the greatest impact on your business and your people. We believe this disconnect lies in the lack of an integrated wellness solution combining education, advisor guidance, and engaging financial tools that can be applied to one’s everyday financial life.

HOW TFO LIVEWELL IS CLOSING THE FINANCIAL WELLNESS GAP

Providing the Financial Wellness Program You Deserve

Proactive financial education and important tips and tricks

Reactive financial tools to bring your financial world into one place

Active guidance and advice from your TFO Wealth Partners adviser

Because we believe financial wellness is only one component of someone living their best life, we can supply your business and colleagues with a program that focuses on combining efficient financial planning technologies and education with guidance from the TFO Wealth Partners team. Our goal is to help your people create a clearer path to their ideal financial world. Here are the tools we are proud to provide through TFO LiveWell:

The Three Components of TFO LiveWell

1

Fully digital, self-paced, 15-course financial education curriculum to teach the fundamental foundations of wealth.

2

A personal wealth planning program to help achieve financial wellness in just 3 minutes a week.

3

The TFO Wealth Partners team is ready to help ensure your people’s goals are aligned and within their reach.

At TFO Wealth Partners, we seek to do more and be more for you. A large focus of ours has been developing a robust financial wellness program that delivers insightful education, and financial planning tools that can provide additional clarity and guidance to your financial life. We believe we’ve accomplished this with TFO LiveWell.CHRIS WINTERS, CRPS™

Director of Retirement plan services

TFO Wealth Partners

Our Proactive Financial Learning Program: TFO RightTrak

TFO RightTrak is an enjoyable and engaging financial education program to help our plan participants learn (or brush up on) the fundamental foundations of managing, protecting, growing, and sharing wealth. We believe this education serves as the foundation for being able to apply these financial practices to your everyday life.

-

Learn the fundamentals of managing, protecting, growing, and sharing wealth.

Our customized classes teach the fundamental foundations of wealth, including budgeting, banking, credit cards, insurance, investing, taxes, and much more.

-

Learn simplified, actionable strategies you can begin to implement into your financial plan today and in the future.

Classes go far beyond its content. We push learners to retain important fundamentals with “how-to” guides, helpful checklists, and many other essential financial planning items.

-

Acquire a lifetime of healthy financial habits to help get you where you want to go.

Apply these lessons learned to your financial life – separate ‘needs’ and ‘wants,’ implement helpful savings practices, and continue to invest for your long-term financial future.

-

A fun, engaging and gamified learning experience.

We believe financial learning should be easy, fun, and engaging. TFO RightTrak makes the complex simple and enjoyable through a customized learning experience, including games, assignments, videos, quizzes, scenarios, and more.

TFO RIGHTTRAK

Empowering Users to Learn the Fundamental Foundations of Wealth

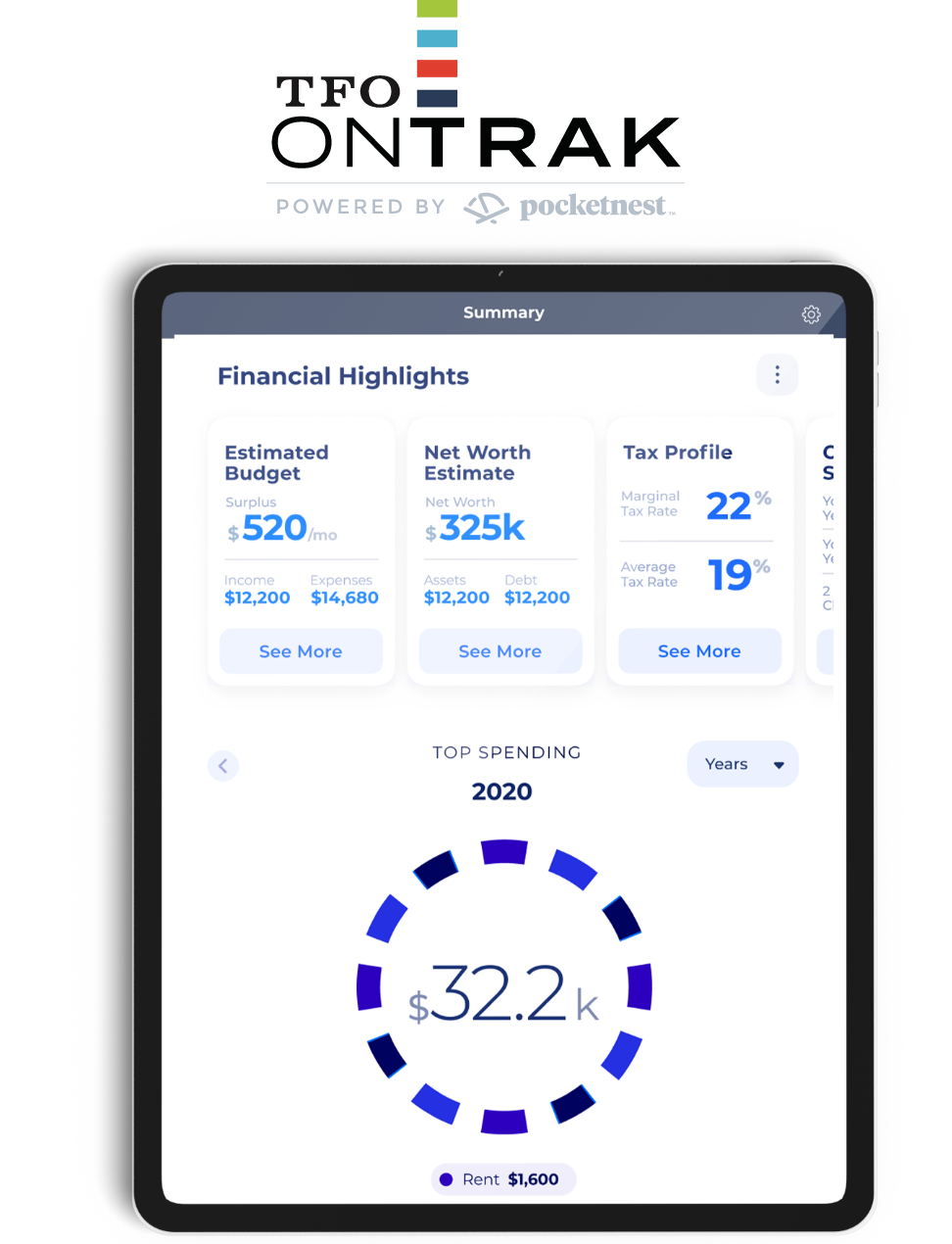

Our Reactive Financial Wellness Program: TFO OnTrak

TFO OnTrak, powered by Pocketnest, puts to work all the financial strategies one learns in TFO RightTrak. Use TFO OnTrak to create and stick to a comprehensive financial plan—that’s unique to you, your lifestyle, and your goals. Link your accounts to get a more comprehensive and personalized plan.

-

3 Minutes to Financial Wellness

Gone are the days of sweating over spreadsheets. Use TFO OnTrak to achieve financial wellness in just 3 minutes a week. We’ll walk you through all 10 themes of financial wellness, while identifying gaps in your plan, guiding you to set meaningful goals, and mapping a pathway to achieve them.

-

Comprehensive Financial Plan

TFO OnTrak will coach you through all 10 themes of financial wellness, from creating a budget to planning for the future—like investing your hard-earned cash or saving for your kids’ college. Want to open an account or dive more deeply into your plan? Connect with your TFO Wealth Partners adviser to learn more on how we can help.

-

Actionable To-Dos

We’ll help you create—and stick to—a comprehensive financial plan with personalized tips and recommendations, all based on Certified Financial Planning curricula. Earn badges as you dig more deeply into your financial plan and get soft nudges and personalized tasks to keep you “on trak.”

-

Your Information is 100% Secure

We take your privacy very seriously. Your data is safe with bank-level-security and is protected by 256-bit encryption. All passwords are stored securely, and we never store your financial institution login information or data.

TFO OnTrak Powered by Pocketnest

Your Path to Financial Wellness and Ongoing Insights

Active Guidance and Education

Contact Our Retirement Plan Services Team Today to Learn More About TFO LiveWell

Once connected to our TFO Wealth Partners retirement plan services, we are here to help you with any questions you or your people may have. Whether it’s questions about their financial plan, your retirement plan provider, or anything in between, we are always ready to get your team what they need. If you’d like to speak with us further about TFO LiveWell, call us, or use the fillable form below.

📞 419-891-9999